David Liss’s protagonist Benjamin Weaver is the black-sheep son of a recently murdered Jewish stock-trader in 18th Century London. In A Conspiracy of Paper Weaver tracks his father’s killer in private-eye novel procedural fashion – roughing up small-time street urchins, checking in with his wise but eccentric sidekick, flirting with his beautiful love interest, in turn getting roughed up by tougher criminals, all while seeking clues to solve the mystery.

Adding to the historical interest, we explore Weaver’s world at a moment of financial transformation. The stock market, letters of credit, and bank notes are quickly replacing traditional sources of wealth. Whereas Trollope and Austen describe the 19th Century world of English gentry – with their status built upon inherited real property – Liss describes a scrappier 18th Century Jewish and merchant-trading world built on hustle, fists, securities trading, and street-smarts.

The ones who push for and benefit from this transformation in London are the foreigners and Jews, outsiders to the traditional English wealthy aristocracy.

Weaver describes his first visit to Jonathan’s Coffee House, one of the active stock exchanges, where ‘stock-jobbers’ trade paper and run lotteries. We’re witness to a virtual Tower of Babel:

“Looking about me, I could see why my Christian neighbors were so quick to associate Jews with ‘Change Alley, for there was a superfluity of Israelites in the room – perhaps as many as I had ever seen together outside of Dukes Place. But Jews were hardly dominant in Jonathan’s and by no means the only aliens. Here were Germans, Frenchmen, Dutchmen – and Dutchmen aplenty, I assure you – Italians and Spaniards, Portuguese, and of course, no shortage of North Britons. There were even some Africans milling about, but I believed they were servants, and not upon the ‘Change for business. The room was a cacophony of different languages, all being shouted at once. It was a dizzying array of papers changing hands, of pens signing, of envelope-stuffing, of coffee-pouring, and of coffee-drinking. I thought it the very center of the universe itself, and I admired in no small degree any man who could conduct business in a place of such distraction.”

Chaotic markets

Participants in these exchanges use manipulation, rumors, inside-trading and false-stock issuances to gain an edge over rivals and the markets. Like many participants in a stock market today or then, Weaver has very partial information. His clients are not who they seem. Multiple competing interests hide facts and motives from him. He’s quick, but the whole scheme of his father’s death remains elusive.

Anti-Semitism

Jews may be important in this 18th Century world, but casual and pervasive anti-Semitism rules society. Weaver suffers continuous insults from the English gentry with whom he interacts, but still manages to assert his will. Prior to becoming a private eye, he had built his street-tough reputation as a successful boxer, the ‘Lion of Judah.’ His tough-guy exterior as well as a thick-skinned confidence serve him well under the constant onslaught of prejudice.

Market fraud

The imminent collapse of the South Sea Company menaces Weaver’s world. His father’s death clearly stems, in part, from a conspiracy to hide the shaky and likely fraudulent dealings of the South Sea Company. The Bank of England – then a private company – competes with the South Sea Company and resists its entrance into dealing in government debt. When Weaver receives assistance from a prominent member of the Bank of England in his investigation, is it because that member seeks to undermine the South Sea Company?

To read present-day internet comments on the financial news (Important advice: Never read internet comments on anything) many still resist the move from physical assets to unsubstantial paper or ‘notional’ stores of value.

Television news on certain stations runs constant advertising on the seeming substantiality of gold over paper money or insubstantial stock and bonds. This paranoia extends to the mysterious money creation and restriction of the Federal Reserve. Whenever a financial crash occurs a portion of observers will throw up their hands and retreat from markets, while another portion spots a conspiracy somewhere in the shadows.

Reading A Conspiracy of Paper we think: Perhaps not much has changed since 18th Century London.

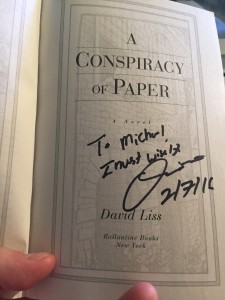

I recently met author David Liss, a fellow San Antonio-transplant who lived for a time in my Manhattan neighborhood. When I heard he’d written a historical financial thriller, I knew I had a to read and review it. Two more David Liss novels featuring Benjamin Weaver await me, The Devil’s Company and A Spectacle of Corruption.

Others clearly enjoyed A Conspiracy of Paper as much as I did, as it won the Edgar Award for “best first novel” in 2001. My daughter enjoyed Liss’ latest book, the sci-fi novel Randoms.

Please see All other Bankers-Anonymous Book Reviews in one place!

Please see other book reviews of finance-oriented novels:

The Way We Live Now by Anthony Trollope

And other review of books for kids by a San Antonio-based author:

Going Going by Naomi Shihab Nye

The Turtle of Oman by Naomi Shihab Nye

Post read (454) times.