I argued in recent posts here and here that public school employee 403(b) retirement plans are confusing to enroll in and full of extremely expensive options, and that the bad program design seems to be on purpose, as it serves one particular industry1, at the expense of retirees.

The situation is so obviously bad that I figured surely public school employee advocates would be working hard to correct this problem. I reached out to public school advocates, as well as to the Teachers Retirement System (TRS) and legislators, hoping to find some good news.

I have no good news to report.

But first, I want to clarify a point that may have gotten lost in my attack on the status quo of 403(b) plans. I do not want to leave anyone with the impression that 403(b) plans should be ignored as a retirement tool by school district employees. Nothing could be further from my beliefs.

Between the automatic payroll deduction and tax advantages of 403(b)s, combined with the fact that TRS pensions won’t cover enough costs in retirement and the lack of Social Security for 95 percent of school districts in Texas, these defined contribution plans ought to be a key tool for retiring comfortably.

The fact that the status quo design of these programs is objectively terrible shouldn’t dissuade you from participating in them, or in an Individual IRA, if you know how to do that, and properly navigate your way to good products. Some how, some way, you need to put some retirement money away in addition to your TRS pension, which will prove insufficient, unless you put in a full 43 years to qualify for 100 percent of your last five years’ salary. Got it? Good.

Now, I have my hair on fire about 403(b) program design, so I began calling around to public school employee advocates. We need some allies here.

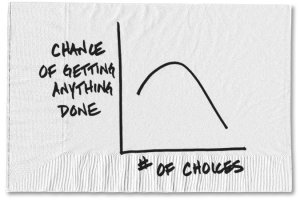

I called the Texas State Teachers Association (TSTA), with a statewide membership of 65,000 and an affiliation with the National Education Association (with 3 million members). Spokesman Clay Robison told me, “Generally, we’re in favor of defined benefits,” by which he means the guaranteed TRS pension that employees qualify for over time. When I tried to shift the conversation toward 403(b) plans, he wanted to emphasize that their organization believes defined contributions are “obviously riskier,” and that recent studies show retirees benefit more from defined benefits (like TRS) rather than defined contributions like 403(b)s. Robison continued, “Our focus is keeping the teacher’s retirement program sound, and keeping the system from moving from a defined contribution to a defined benefit plan. If teachers want to invest in a defined contribution plan, that’s entirely up to them.”

To my pressing that fixing 403(b) plan design doesn’t take away from the TRS pension, he replied, “We’re focused on the defined benefits plan, because we’re convinced it’s the best option and it’s less risky. The TRS is a sound pension plan. Managed by professionals. For those that can afford extra, that’s their business.” Ok, then.

I spoke with Bobbye Patton, past President (2012-2014) of the Association of Texas Public Educators, a non-union organization representing 80,000 members statewide. She said the issue of 403(b) plan reform has simply never come up within her organization. “I cannot remember that our association has talked about the 403(b). It’s always been focused on the retirement system itself.

“We have our TRS (pension). As far as I know, nobody pushes ideas about the 403(b). As teachers, we don’t understand it. We don’t fully understand what it would do for us.” Alrighty then.

Calls to the San Antonio Teachers Alliance, a local affiliate of the Texas AFT, and itself a state member of the national AFLC-CIO, did not get returned as of this writing.

I spoke to Rebecca Merrill, Chief Strategist at TRS itself, which is legislatively charged with administering and executing 403(b) rules statewide.

I wanted to know whether they are aware of the problems of 403(b) plan design, specifically forbidding school districts from designing a better system through a bidding process and negotiation. She assured me they understand the issues well.

“I don’t think its any secret that we’ve said ‘if it’s the legislature’s will for teachers to pay as low fees as possible, they should empower district to issue RFPs (Requests for Proposals) and negotiate lower costs.’” I asked if TRS itself could negotiate better terms for school district employees at the state level.

Merrill responded, “We feel like we can’t. The legislation provides for an open access system. The industry pushed back and said the legislature wants choice.”

To be fair, Merrill points that certain very heavy sales load charges on funds were dropped in the 2017 reform, and I agree that’s good. Merrill also pointed out that allowable fee caps on products were lowered, although I still believe the move to be very incremental only.

In reviewing the results of 2017 reform of fees within the 403(b) plan, I expressed to Merrill that this was “reform” that only an insurance company could love.

Merrill responded, “We made some recommendations for the (TRS) Board to go in a different direction. The Board did adopt some rule changes, including the fee caps. The Board heard from industry, and they heard from staff. We had a big dialogue with the industry. The industry wanted to make sure that advisors could be compensated. We worked through it the best we could.” At the end of the day, however, Merrill believes TRS cannot make the rules around 403(b) plans, nor can it interpret policy. “We are mindful that how 403(b) is implemented is a legislative question.”

Emailed questions and call to the office Representative Diego Bernal, San Antonio Democrat and Vice Chair of the House Education Committee went unanswered. Emailed questions and a call to the office of Senator Paul Bettencourt, Houston Republican and member of the Senate Education Committee as well as an advocate for shifting away from defined benefits and toward defined contribution plans, went unanswered.

And that, folks, is the depressing state of the world, with respect to the perfectly legal highway robbery going on with school district employees’ defined contribution plans.

Don’t look to teachers lobbies, the legislature, or TRS itself to fix this anytime soon.

A version of this post previously ran in the Houston Chronicle and the San Antonio Express News.

Please see related posts:

The problem of choice in Texas teacher 403(b) plans

Teacher Retirement “Reform” Only An Insurance Company Could Love

Variable Annuities, aka Shit Sandwich

Variable Annuity Salespeople: Just because you’re paranoid doesn’t mean I’m not out to get you

Post read (282) times.

- The insurance industry, duh ↩