April’s big higher education philanthropy news left me grumpy. I mean, yes, it’s nice that financier Ken Griffin has pledged a gift of $300 million to Harvard University. In exchange Harvard will rename its Graduate School the “Kenneth C. Griffin Graduate School of Arts and Sciences.” Higher education is good, philanthropy is good, and Harvard is good. It should be all good.

Still, here’s why I’m grumpy. Harvard is the least worthy use of hundreds of millions of philanthropic education dollars I can possibly think of. They need it the least.

Among universities, Harvard already boasts the largest endowment of any university. With $50 billion under management, cynics (like me) have long quipped that Harvard is a world-class hedge fund with a fine educational institution attached to it.

Harvard does not really elevate learning in our larger society, except in the most extreme trickle-down kind of way. The profile of a student actually boosted by Griffin’s donation is extremely narrowly selected. A $300 million gift seems like a bizarre over-allocation of resources to people for whom resources are truly not scarce.

Among 4-year colleges, Harvard is already quite generous with families of demonstrated financial need. But these students admitted from low socioeconomic strata are extremely few. The path into Harvard is so narrow that only rarely does a student from a lower-income family gain admittance. Second, these narrowly selected students – rich, poor, or middle class – probably would thrive wherever they went. Third, most of Harvard is made up of students from relatively privileged backgrounds, making the institution far less impactful on society as a whole, when considering it as a recipient of philanthropy.

Griffin giving $300 million to Harvard helps an organization that doesn’t need it, which in turn serves mostly students who largely don’t need it, or students who would succeed without it.

What Ken Griffin mostly bought for his $300 million was naming-rights as a monument to himself in perpetuity, burnishing his own reputation as a “success,” via brand-affiliation with Harvard. A personal monument and a name brand. It’s Griffin’s money and he gets to prioritize what he wants. But the gift just struck me as the worst kind of higher-education philanthropy.

Meanwhile, the contrast with the very best in higher education philanthropy is very stark.

In the midst of the pandemic in 2020 and 2021 MacKenzie Scott – author, philanthropist and via divorce from Jeff Bezos a 4 percent owner of Amazon – set a new and better standard for higher education philanthropy. Scott’s lessons were ones that Griffin either didn’t notice or chose to not learn.

She gave billions in total to organizations vetted for accomplishing great work but that suffer from insufficient resources. The opposite of Harvard in terms of need. She gave to hundreds of organizations that actually needed the money.

She thoughtfully targeted institutions – like Big Brother Big Sister, or community colleges, that serve a broad and inclusive swath of people who themselves had insufficient resources. Again, the opposite of Harvard. People who actually needed the support.

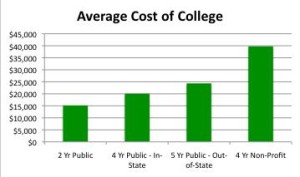

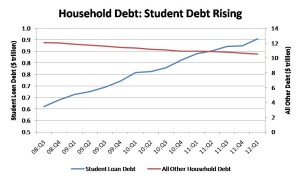

Because social and economic class is self-reinforcing (in contrast to our national myth of social mobility) higher status and more selective higher education institutions matriculate students from higher income families, on average. Also, higher status and more selective institutions generally cost more. As a result, if you want to help social mobility through increasing educational opportunity, the place to focus is regional and community colleges. So that’s what Scott did. That’s where the transformation in people’s lives and in society is likely to take place.

At Harvard, less than 12 percent of students come from the bottom 40 percent of households by income. A larger cohort at Harvard, 15 percent of students, come from the top 1 percent of households by income. All of this is according to research done by Harvard’s own Raj Chetty and a team of economists.

At UT Austin, 15 percent of students come from the bottom 40 percent of households by income. Which itself is a result of its highly selective status. At UT San Antonio, 26 percent of students come from the bottom 40 percent of households by income.

In Bexar County’s Alamo Colleges, 43 percent of students come from the bottom 40 percent of households by income. So that’s where Scott gave. Where the students with the most financial need are actually studying.

The socioeconomic origin of families of students is just one measure – but an important one – of the role higher education does, or does not play, in creating pathways to social mobility.

For all of Harvard’s successes in championing lower socioeconomic access to higher education – a pitch made with just about every alumni solicitation for donations that it sends out – a much more effective way to support this cause would be to donate to higher education institutions that truly serve middle and lower-income families. Like community colleges, or public universities that serve a region or state.

In San Antonio, Scott gave $20 million to San Antonio College, and $15 million to Palo Alto College, both part of the Alamo Colleges District.

Dr. Mike Flores, Chancellor of the Alamo Colleges District, admires Scott’s philosophy of giving to under-resourced communities. Further, Scott allows the recipient institutions full discretion in how to best spend her gifts.

Scott’s donations went into programs such as $4 million to support students in high-demand degrees in tech or nursing that will likely transform their lifetime economic prospects for the better. $5 million went toward the $75 million endowment for AlamoPROMISE, which provides scholarships to make an Associates degree affordable for most area high school students.

I think what MacKenzie Scott got for her $25 million to Alamo Colleges was life-transforming social mobility among people who need it most. And they didn’t name anything after her. She doesn’t really get bragging rights through brand affiliation with a community college. Instead she just gets to make a difference.

A huge priority for Alamo Colleges is to make sure any area high school graduate can get free or greatly subsidized tuition, with wrap-around services, on the way to getting an Associates degree, what Dr. Flores deems the “moonshot” program known as AlamoPROMISE.

Dr. Flores, when asked how he thinks about transformational gifts in higher education, “Just imagine, an $80 million dollar gift could guarantee graduating high school seniors access to AlamoPROMISE in perpetuity for Bexar County graduates for decades.”

Scott didn’t build a monument to herself when she gave her gifts, but she demonstrated a far better philanthropic model than the old one Griffin followed this month.

Harvard is not a bad institution. It represents greatness in many fields and is a cool place for a fortunate few. As a destination for philanthropic dollars, I just would personally place it last on my list.

Disclosure: In 2022 I offered consulting services – online personal finance lessons – for employees of the Alamo Colleges District.

A version of this ran in the San Antonio Express News and the Houston Chronicle

See related posts:

Post read (48) times.