Far be it for me to stand in the way of progress, but did a little part of you die when you read this morning that Fair Isaac Corp will slightly alter its FICO score formula to make it easier for people to get loans?

Far be it for me to stand in the way of progress, but did a little part of you die when you read this morning that Fair Isaac Corp will slightly alter its FICO score formula to make it easier for people to get loans?

Is nothing sacred?

Decline of Western Civilization?

My immediate thought was that deflated feeling I got when I heard, in 1995, that the College Board would recenter the SAT to 500, because average scores kept dropping. Ugh. How would I know whether my SAT scores are higher than my kids’ scores? We can’t even compare now.

How will kids develop a competitive drive if they don’t know how their old man did on the SAT?

I remember when not every kid would get a shiny ribbons for “participation.” Instead, we would only get the giant trophy if you WON, and pummeled your youthful opponent into abject submission.

I mean, I remember when I used to walk all the way to school, uphill both ways, in a driving blizzard. And back for lunch.

And we loved it.

FICO scores

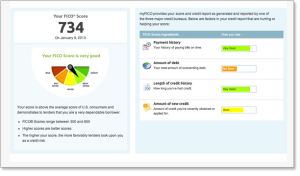

Anyway…back to FICO. According to the WSJ this morning, the makers of FICO will drop ‘settled’ delinquent accounts from their formula for calculating their key number used by practically every US lender in consumer credit decision-making. The result is that for people who had made late payments or let debts go to collections – but later paid or settled the accounts – the negative mark on their credit will drop off quickly.

The second change in the FICO formula is to de-emphasize the negative effect of delinquent medical bills.

Since FICO scores have traditionally been quite sensitive to a history of delinquent payments, the result is that millions of people could see their scores rise as a result of the formula change. Higher scores theoretically means that more people will have access to credit.

The point of the FICO score – for lenders – is to offer a snapshot of the probability of future consumer loan defaults. Fair Isaac says they studied whether the history of delinquent – but paid – accounts mattered to calculating these probabilities. Following the study, they said they could reliably drop the paid collection accounts, as well as lower the impact of medical delinquency and still maintain the same predicative power in the score.

A caveat

Although this change made the front page of the WSJ this morning, the real impact could be completely unrealized. Deep in the article Fair Isaac Corp says they will implement this more forgiving FICO formula via a new score called “FICO 9,” which makes it sound like this is just a supplemental score that banks could decide to pay attention to, or not.

Lenders make their own decision about what FICO score to buy, and they may not choose to shift from traditional FICO to FICO 9.

Like a college deciding to review the ACT rather than the SAT. So we’ll have to see whether banks adopt the new score or just ignore it.

Post read (4484) times.