Happy Fiscal Gorge[1] Day!

Happy Fiscal Gorge[1] Day!

Guess who’s really happy from last night’s tax deal? Heirs, financiers, and people who live off their piles of money.

Guess who’s not saddened by the Fiscal Gorge tax deal? The top 2% of earners that Obama spent his campaign promising would pay a larger share of federal taxes if he won.

Let me explain what I mean.

All along this Fiscal Cliff discussion our leaders have focused our attention on top marginal tax rates and top income thresholds for taxing ordinary income, as if that was the most important way to raise revenue while simultaneously addressing growing societal inequality.[2] The sticking point in discussions, at least in so far as most media followed it, appeared to be whether top income earners would pay the existing 35% income tax rate or Obama’s preferred 39.6% income tax rate, and where in the range between $250K and $1million in income that higher rate kicks in.

Why do wealthy folks celebrate the Fiscal Gorge? Just this: If you’re Sheldon Adelson[3] you really couldn’t care less about ordinary income. What matters most are estate taxes, dividend taxes, and capital gains taxes. Adelson makes $1 million a year in ordinary income, now taxed at a higher rate. No big deal. He makes billions of dollars in dividends and capital gains, now permanently taxed at 20% for Adelson. Now that’s a big deal. Now that’s cool.[4]

Did you notice what happened to those taxes?

Estate Tax: The estate tax exemption rises to $5 million, up from the $1 million it would have been without a Fiscal Cliff deal, and up from $675K when George W. Bush came into office. The tax rate on inheritance locks in at 40%, down from 55% at the beginning of the Bush Administration. Throughout the Bush administration the estate tax exemption stepped up each year or two, and the estate tax rate stepped down every year or two. Under the Obama administration, with the new Fiscal Gorge law passed, the W. Bush-era generous estate tax rates become permanent. Richie Rich is so happy.

Dividends Tax: If you were Sheldon Adelson – which you are not, but let’s pretend you were – right now you would be celebrating a Happy New Year because you just took a special dividend payout in December 2012 from Sands Casino of an estimated $1.2 Billion, based on your ownership of 431.5 million shares and a declared dividend of $2.75 per share. Adelson took the dividend in December fearing that his 15% dividend tax rate might rise to something like the 35% or 39.6% ordinary income tax rates, which would cost him close to $300 million in additional taxes in 2012. He needn’t have worried. The Fiscal Gorge law makes a 20% dividend tax rate permanent for folks in Adelson’s income range, a pillar of the Bush administration’s tax cuts. The dividend rate stays at the 15% rate for those earning less than $450K.

Capital Gains Tax – This tax rises from 15% to 20% under the Fiscal Gorge law. Given that top earners and top wealth holders benefit substantially from capital gains, the permanence of this change represents another victory for Bush-era tax cuts.

My logical mind tells me that political leaders and the media underplay the importance of these taxes because, firstly, they only somewhat affect the highest earning 10% of American citizens, and secondly, these taxes only substantially affect the highest earning 1% and above. So the majority of the electorate and the majority of the media-consuming public doesn’t really know or care about these taxes. It’s only logical they would ignore those taxes that are irrelevant to the majority of people, right?

My more paranoid mind[5] tells me that it’s convenient for political leaders on both sides of the aisle to ‘hide the ball’ when it comes to tax discussions because you can enact a devastatingly effective ‘win’ for Republicans while at the same time allowing Obama and the Democrats to point to higher marginal taxes on ordinary income as if they scored something important.

They didn’t. They got rolled, at least when it comes to tax policy.

When it comes to spending, of course, they delayed any cuts in government spending. Which I suppose makes Democrats feel smug as well.[6]

Which leads to the larger critique and larger structural issue highlighted by the Fiscal Cliff process.

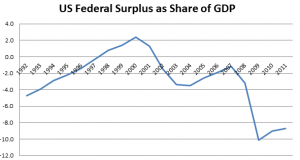

- The Fiscal Cliff was an invented political crisis technique – which managed to hold the economy hostage – to force compromise and hard, responsible, fiscal choices from elected leadership.

- The resulting Fiscal Gorge law, in the end, involved no significant compromise. Republicans got overwhelming tax cuts, permanently enacted, and Democrats got all their desired spending continued for a little while longer. So we got the crisis, but no real compromise. Thanks guys, awesome job.

- It’s easy to cut taxes. Everyone’s happy. It’s also easy to spend a lot of money because, again, everyone’s happy.[7] The hard part is cutting spending or raising taxes, the two things required to, you know, pay our extraordinary debts.

- Hard choices like raising taxes or cutting spending require compromise and long-term thinking, of which we received no evidence of either throughout the Fiscal Cliff crisis.

One additional point about tax policy and my use of Sheldon Adelson as an example of a wealthy citizen.

I pick on Sheldon Adelson because, in the new era since the Supreme Court’s Citizens United decision, which allows for unlimited campaign contributions as a First Amendment-protected ‘free speech right,’ Adelson represents the paragon of a stated willingness – and most importantly ability – to use money to tilt the political process in his favor. Multiples of those same campaign contributions then return to him through favorable tax treatment.

Adelson has become – for me at least – a short-hand way of pointing out a glaring structural flaw in our electoral democracy. I’ve got no particular animus against his wealth accumulation, and I really don’t blame the guy personally for pursuing his self-interest as he understands it. But we haven’t figured out a way to prevent, for the sake really of systemic integrity, guys like him from tilting the table too far in their favor.

While acknowledging that I’m re-stating the incredibly obvious, I like to talk about Sheldon Adelson simply because he’s my way of showing we’re light on the whole ‘checks and balances’ thing when it comes to the influence of money in politics.

[1] My friend “The Professor” who recently wrote a guest post about Sheldon Adelson, deserves credit for the “Fiscal Gorge”, which naturally follows when you go over the Fiscal Cliff. The actual name for the legislation passed yesterday by the House and Senate to address the Fiscal Cliff is The “American Taxpayer Relief Act of 2012.”

[2] I know, we don’t talk about growing inequality in a straightforward way when discussing tax policy. But that is clearly what Obama had in mind when he campaigned on raising taxes on people who make more than $250,000 a year. Yes, it would have a small effect on fiscal solvency, but it would have a larger effect on our notion of what’s fair in an increasingly unequal society. One simple illustration of the increase in inequality in the United States is captured by the picture of the historical increase in the US’ Gini Coefficient measuring income inequality from 1947 to 2007.

[3] Obviously I’ve written about him already, but he’s an incredibly convenient stand-in for wealthy Americans and their successful capture of the political process.

[5] What!? You don’t have multiple voices in your head debating tax policy at all times? Am I over-sharing? Why won’t you answer me, damn it?

[7] Which reminds me of one of my favorite Jack Handey quotes: “It’s easy to sit there and say you’d like to have more money. And I guess that’s what I like about it. It’s easy. Just sitting there, rocking back and forth, wanting that money.”

Post read (6756) times.