At the end of July the Trump administration quietly killed a retirement program called MyRA , intended to help lower and middle-income people begin investing for retirement.

At the end of July the Trump administration quietly killed a retirement program called MyRA , intended to help lower and middle-income people begin investing for retirement.

Good riddance.

If you are of a certain political cast of mind, you might see the end of the MyRA as another hit job by Wall Street and Big Business against the little guy, just struggling to get started.

That’s not the way I see MyRA’s demise. The real reason this program stunk was the limitation that MyRA holders had to exclusively buy US government bonds, which are simply a terrible asset for retirement investing.

The Obama administration created the MyRA in 2014 to provide starter retirement accounts for workers without access to a 401(k)-style plan. The impulse behind the program, and some design elements of the MyRA, weren’t bad.

MyRA was free to both workers and business owners (yay!), encouraged automated contributions through payroll deductions (yay!), could be opened for contributions of as little as $5 per month (yay!) and simplified investing by putting all money into a special US government Thrift Savings Plan known as the G-Fund (boo!).

The G-Fund is government-guaranteed, so participants in the MyRA would never lose money, although investment returns would remain a blend of government bond interest rates, recently around 2% per year.

Anyone affected by the MyRA discontinuance will now need to roll over their funds to a Roth IRA account, although in reality very few people will be affected. Only approximately 30,000 accounts were opened since 2014, with a mere $34 million overall.

The reported $10 million a year it would cost to run it – the stated reason why the Trump Administration ended the MyRA – wasn’t that much either. The reason to end the program, in my mind, wasn’t the cost of the program or the impulse, but rather a huge design flaw – namely that all participants could only buy government debt.

If I were paranoid about the creation of the MyRA (hint: I’m not paranoid) I could connect the dots of the MyRA rules as an insidious Obama administration plot to force poor people to buy government bonds in order to finance our excessive national debt. That was a hot take among a certain type of political mind at the time of MyRA’s creation. It isn’t the real reason this program stunk.

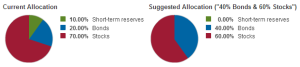

Let me connect the dots in a different way that gets to the heart of the bad design of the MyRA. If you invest for retirement, you by definition invest for the longest run. You invest for your remaining lifetime, or even beyond. At the very least, you invest many decades into your future. As I’ve written many times before and will continue to write until my little fingers get too sore and arthritic for more writing, long-run investing needs to be dedicated to risky assets with a potential for higher returns.

Unless you are already very wealthy and are in a pure wealth-preservation mode (maybe 1 percent of you) retirement investing specifically needs to skew heavily toward higher-return assets. Riskier assets. Like stocks. (fine print: diversified, hopefully indexed, or at least low-cost, mutual funds. But I digress.) Poor people and people just starting to invest – the specific targets of the MyRA program – cannot afford to buy only US government bonds in their retirement account. Their retirement money can’t grow enough with government bonds. That design flaw just killed me. By limiting the returns that MyRA investors could obtain, the design condemned investors to a terrible retirement account that undermined the whole point of long-term compound interest growth.

Let’s do a simple compound growth comparison between a worker making a one time retirement investment for thirty years earning a US government bond return – like 2 percent per year – versus a long-term moderate stock-like growth – like 6 percent per year. That mere 4 percent difference in annual returns will result in 3.7 times more money, thirty years later, for the stock investor. It’s likely the difference between having enough and not having enough in retirement.

I think I know why the Obama administration did it, which was to prevent nominal investment losses for people just starting out. But a bad design does not justify good intentions. MyRA, by forcing its customers to purchase government bonds only, marginalized retirement investing for a group that was already marginalized.

Now that the MyRA is dead, which is fine, we’re still stuck with the policy problem that the MyRA attempted to address.

Namely, the great challenge in finance is encouraging people with limited income and financial knowledge to start savings and investment. How do people who haven’t invested before even get started?

This unsolved problem really explains the lack of uptake for President George W. Bush’s proposal to shift the responsibility for retirement savings from Social Security to individual investment accounts, later (mis-)labeled as “privatizing Social Security.”

If you leave poor or financially unsophisticated people in charge of their own personal retirement, and they fail to save enough, ripping Social Security away leaves Grandma in a cruel spot in her old age.

In the decade since that Bush-era idea ignominiously died, fin-tech companies like Qapital, Acorns, Betterment, and Wealthfront have begun to chip away at this unsolved problem, by radical simplification of the savings and investment process, and by making automated contributions easy to set up via a mobile phone app. Still, they haven’t solved the public policy problem that most people do not save enough and most people who haven’t yet saved enough don’t even know where to begin.

The MyRA was, in that sense, a noble attempt at addressing a tough problem. But limiting the investment options to government bonds – in a horrifically low interest rate environment no less – meant that it would only do a disservice to the people it purported to help.

A version of this ran in the San Antonio Express News and Houston Chronicle.

Please see related posts:

100% Risky Even In Retirement?

MyRA – A Dumb Idea From the Start

Automated Savings with Qapital

Post read (210) times.