I didn’t want to do this. Talk about GameStop, Reddit, Stonks, short-squeezes, hedge funds and roaring kitties.

And yet, here we are.

I didn’t want to do this because part of what I hate about traditional financial journalism is that it focuses on the sensational and statistically improbable, such that the average reader may come away with a twisted sense of what is normal and probable. And therefore the average reader might set a course that is unwise, or cement beliefs that are untrue.

I didn’t want to do this, but then I kept reading the stories that celebrated all the sensational. I fielded questions like – “are short sellers bad? If not, please explain” and comments like “I bought GME, wish me luck.” So I can’t help myself.

My apologies for piling on.

Short-selling is not bad. Short-selling is a necessary market function. Institutional market makers, otherwise commonly known as brokers, go short in the ordinary course of their business to maintain orderly market flow. Other institutional investors have the ability to “go short,” by borrowing securities, selling them at today’s market price, and then hoping to buy them back at a lower price in the future. Sometimes this makes money, when the stock declines. Sometimes this loses money, when the stock price rises. There is no deeper moral meaning to this short selling activity.

Short-selling is part of the plumbing and wiring of financial markets. Short-selling is no more evil than copper wires are evil for lighting up your house. Should you, the non-licensed electrician, touch those copper wires? Hells NO! Step away from those wires. Do not short stocks yourself unless you want to get fried.

Institutional investors do sometimes short stocks. They also use borrowed money, engage in options strategies, and trade for short-term gains and losses. Retail investors should, probably, never do these things. I’m not saying it should be illegal for individuals to do this – we permit harmful vices all the time in a free society among consenting adults – but there should be warning labels and limits and deep discouragements and heavy taxes and all the speedbumps to prevent people from doing themselves much harm.

Robinhood is a financial services app providing an easy-to-use onramp to retail investors. A seemingly-friendly accessible Main Street approach to Wall Street. It should be a morally neutral platform. Unfortunately, it appears to encourage all the worst investment behaviors that Main Street retail investors should not do. Behaviors like using leverage, options, trading individual stocks, short-termism. Robinhood is a menace because it’s going to cost people money, people who probably can’t afford to lose it. And lose they will.

Despite the name, the Robinhood app does not favor the ‘everyman’ over the Wall Street sharps. On the contrary, to the extent it encourages leverage, options trading, individual stock trading and short-term trading, it will, over time, inevitably tend to transfer money away from the everyman toward Wall Street. All under the guise of “democratizing investing.” There are some great “democratizing investing” apps.1 Robinhood just is not one of them.

Reddit is cool. A couple of guys (I think they were mostly guys but on Reddit users can remain anonymous so permit me to just simplify genders here) found value in an unloved stock, GameStop. Many months ago. It was so unloved that many hedge funds had large short positions. In January, a mob of Redditors, and others, engaged in a buying frenzy, a storm-the-capitol type pile-on in that stock. It was as unwise, conspiratorially-fueled, and briefly successful as any shocking market move in recent memory.

To be clear, there is nothing new about a part of this. Attacking short-sellers and making them suffer is a time-honored blood sport among professional hedge fund investors.

What was new was Robinhood investors and Reddit Bros figured out a way to put on their viking caps, fur-trimmed coats and body armor to overwhelm the financial barricades to participate en masse, with the sheer weight of their bodies, (metaphorically, financially, speaking) causing mass hysteria in the stock.

Would-be populists, ranging from Senator Ted Cruz to Congresswoman Alexandria Ocasio-Cortez questioned attempts by regulators to slow down the GameStop frenzy. Their commentary was neither informed nor helpful.

The slow downs, we now know, were designed not to quelch the mob nor to defend short-sellers, but to protect market makers – including especially Robinhood, from failing. They were the Capital Cops of this story trying to do their jobs. Nobody wins when they go down. Unless you are in favor of anarchy. Which I am not.

We also now know that much of the frenzy involved large institutional investors as well as the Reddit Robinhood and Reddit Bro crowd. The Wall Street Journal has reported on $700 million, $200 million, and $150 million gains by traditional hedge funds joining the pile-on in January. I just mention this because the simple David and Goliath story is always appealing in markets, but frequently wrong.

A few other thoughts. I recently argued that despite the fact that traditional inflation in the economy seems tame, that the run-up in real estate and stock markets generally should be understood as a specific form of inflation.

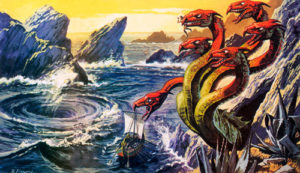

I cannot prove the following, but I believe it: The frenzy in GameStop, like the parallel ephemeral frenzies in stocks like Tesla and AMC, cryptocurrencies like Bitcoin and Dogecoin, and commodities like silver seem to share a mob-like desperate quality. My thesis – again just my belief – is that the easy monetary policy from the Federal Reserve (low interest rates, huge securities portfolio) has created an ocean of extra cash, sloshing around the capital markets. The excess liquidity sloshing around creates waves and then occasional rogue wave tsunamis. The appearance of these rogue waves in the markets are a kind of inflation.

They are dangerous and possibly destructive, but only if you put yourself in harm’s way. Stay inland, and defend your castle against the viking hats.

A version of this post ran in the San Antonio Express News.

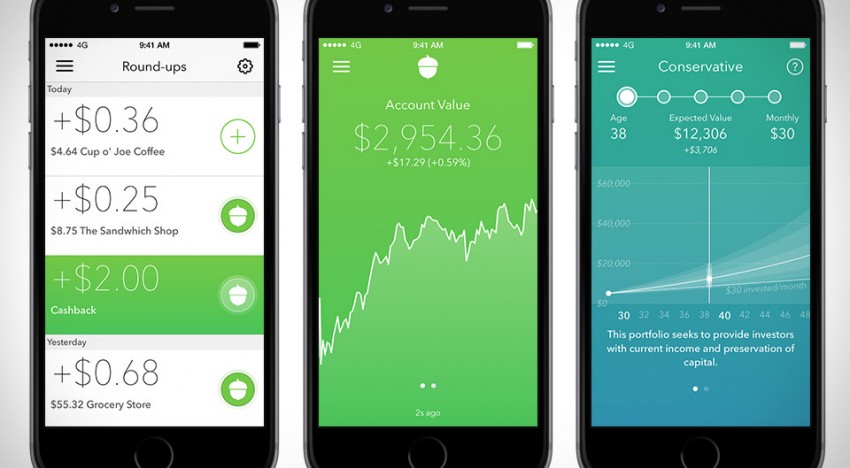

Public Service Announcement: Please use better investing apps than Robinhood.

Like Acorns (my favorite)

or Like M1 Finance

or Like Qapital

Post read (231) times.

- Specifically, I think Acorns is amazing and everyone should open an Acorns app right now ↩