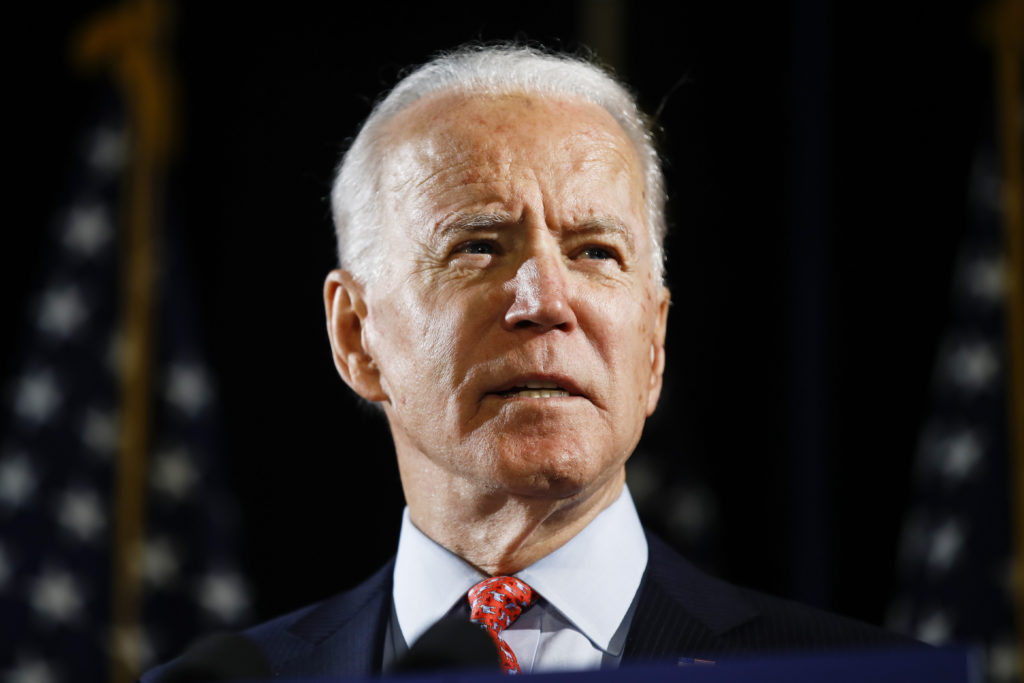

I do not expect President Biden to actually use executive powers to eliminate large chunks of student loan debt, although it appears from news reports that he’s strongly considering it. One in five Americans has student loan debt, and our $1.6 trillion collective balance is higher than our total credit card debt balances.

I neither expect it, nor do I favor it. My objections, briefly summarized:

- Debt cancellation favors higher income folks, as high debt correlates with high income.

- It seems poorly targeted for eliminating inequalities.

- It is complicated by the obvious political perceptions of unfairness: People who already paid off their debts, people who never took out debt in the first place, and people who will take out debt in the future all have a potential complaint. That’s a lot of constituencies who may feel broad debt forgiveness is unfair to them.

To state the obvious: When one in five Americans suffer under the burden of student loan debt, four in five do not.

The future “fairness” perceptions around debt forgiveness depends on whether forgiveness feels societally “earned.” A case can be made that public sector workers – think military, police, fire, educators – deserve a shot at forgiveness following a period of service. That feels less controversial.

Interestingly, programs already exist – in theory – for this type of public sector worker student loan forgiveness, primarily the Public Service Loan Forgiveness created in 2007 and the Temporary Expanded Public Service Loan Forgiveness program passed in 2018. The promise of the program was that borrowers who made ten straight years of on-time payments – and worked for ten years in public sector jobs – would have their remaining loan balances forgiven. The second program was passed by Congress in 2018 to make up for failures of the first program. Then the second program failed.

A study by the General Accounting Office (GAO) from 2019 attempted to explain why only 1 percent of applicants to the Temporary Expanded Public Service Loan Forgiveness Program received forgiveness.

The OMB found the application process confusing to the point of impossible. They cited the Education department’s outreach as insufficient. The department’s own website did not provide information on debt forgiveness. Private sector servicers were not obligated to provide information about loan forgiveness. These all likely contributed to the failure of the program.

Michael Lewis – author of Moneyball, Liar’s Poker, The Big Short and The Undoing Project among others – is probably our country’s best financial journalist.1 His podcast “Against The Rules,” offered an explanation on the failure of public sector loan forgiveness, even before that OMB report was issued.

In Lewis’ second podcast episode, which first aired in April 2019, he explored the ways in which giant student loan-servicing company Navient steered borrowers away from qualifying for loan forgiveness.

Specifically, Navient encouraged borrowers to take advantage of forbearance if they experienced hardships. Unfortunately, forbearance meant that borrowers could no longer qualify for public service loan forgiveness at the end of ten years. The ten-years-of-payments clock would restart, a fact apparently not mentioned or emphasized by Navient employees.

In addition, Navient’s call center workers were highly discouraged from spending enough time to walk consumers through the complex steps they needed to follow. Lewis points out that Navient was paid per account, and would lose accounts if borrowers qualified for forgiveness. Also, spending too much time on the phone with borrowers cut into Navient’s profitability.

Technically, yes, public service sector workers could apply for loan forgiveness, but Navient’s own financial incentives were to not offer the best advice to borrowers.

If you enjoy making yourself angry at a big consumer finance institution, you’ll want to listen to the podcast. These types of perverse incentives also probably explain a big part of why so few public sector employees qualified for loan forgiveness.

One obvious conclusion we could make is that if President Biden pursues loan forgiveness for public sector workers, or more universally, we should hope he either replaces or makes massive improvements to this failed program.

Like a lot of what happens with consumer finance, the issue is not so much that it is impossible to avoid traps and to properly navigate borrowing. The real issue is that the burden of doing the right thing has been shifted entirely to an unsophisticated consumer. Could that consumer do all the right things? Maybe. But it’s unlikely. Specifically, as we’ve seen, it’s about 1 percent likely.

As a starting point, I’m usually in favor of “personal responsibility” when it comes to our finances. We should learn what we can, and try our best to solve our own problems.

But when less than one percent of people qualify for an extraordinary benefit like loan forgiveness, it’s not right to make personal responsibility the watchword for navigating consumer finance. Instead, it’s probably a case for better design of the program. And better regulation. And for putting the burden of success on the companies and governments – who understand the products best – rather than on consumers, who understand financial products poorly.

Tony Isola, a money manager and consistently astute commentator on bad financial products, recently dubbed the student loan servicers the “murder hole of consumer finance.” That’s a pretty good turn of phrase.

The Trump administration extended the pause on mandatory student debt payments, initially passed through the April 2020 CARES Act, until January 31 20201. A $1.6 trillion debt reckoning is upon us.

A version of this post ran in the San Antonio Express News.

Please see related post

The Burden of Understanding Should Be On The Companies

See related book reviews of Michael Lewis books:

Post read (149) times.

- Oh, stop it. You’re too kind. But, really, Lewis is the best. ↩