On timing in investments and personal finance, as it relates to my home mortgage

On timing in investments and personal finance, as it relates to my home mortgage

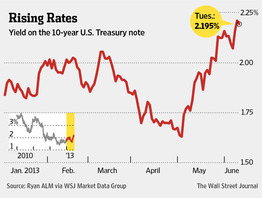

Did you see the front page of the Wall Street Journal today? Yeah, that graph that showed 10-year bond yields up 0.5% in the past two months? Oh boy that made me so happy this morning.

I locked in my new 15-year mortgage rate at the end of April. Yup, just at the low point in the graph.

Then, I closed on my mortgage refinancing this week.

Which means that today, I am a Golden God of mortgage refinancing timing.

Timing is stupid

As an investment rule, I don’t believe in timing.

Or rather, I believe in the opposite of timing, which is that when it comes to investments and personal finance you’re supposed to keep doing the same boring, unsexy, basically correct thing[1] no matter where we are in the interest rate cycle, business cycle, stock market cycle, or Elliott Wave[2] cycle.

However.

I am also human and not immune to the need to react to external financial conditions and to believe myself clever and responsive to said external financial conditions.

So whenever the stock market severely crashes, I feel the need – to both honor my contrarian nature and as a totemic superstitious thumbing of my nose at the market – to buy stocks. This has produced mixed results – as I’m always too early in catching a falling knife[3] – but it makes me feel powerful and clever and unbowed. Take that, market! I am investor, hear me roar! I am telling the Ballrog: You shall not pass!

I mention all of this because as far as personal finance timing goes, I just made my best trade ever. This week I refinanced into a 15 year mortgage at 2.75% and I am feeling great. In sum: I am a Golden God.

In the last 50 years, mortgage rates have never been lower than the rate I just locked in.

Of course, this same statement – “mortgage rates are at the lowest level we’ve seen in a lifetime!” – could be made at almost any point in the last 30 years. I myself have predicted about a dozen of the last nonexistent interest-rate hikes.

So my timing may not be as amazing as it feels. But still, let me bask for a moment in what might be the only good timing trade of my investment life.

Basking

I am pleased I got this refinancing done – It’s pretty arduous getting a mortgage approved by any underwriting process these days.

I am pleased I got the lowest rate I could have imagined – No way could I have predicted this rate even a few years ago.

I am pleased I got a 15-year mortgage rather than a 30-year mortgage – since it takes rock-bottom mortgage rates to an even rockier bottom level.

The timing-junkie in me – acknowledging the silliness of timing – wants to have low-ticked the mortgage market. The 0.5% climb in 10year bond rates and the uptick from 2.75% to 3% for 15-year mortgages in the past month has me feeling smug.

Please see Related posts:

Part II –Ask an Ex-Banker: Should I pay my mortgage early?

Part III – Why are 15-year mortgages cheaper than 30-year mortgages?

Part IV – What are Mortgage Points? Are they good, bad or indifferent?

Part V – Is mortgage debt ‘good debt’ A dangerous drug? Or Both?

Part VI – What happens at the Wall Street level to my mortgage?

Part VII – Introduction to Mortgage Derivatives

Part VIII – The Cause of the 2008 Crisis

[1] To be most specific, ideally ensure a modest surplus every month and blindly put that surplus into an investment vehicle. Also, make it a risky vehicle if you’re young and a less risky vehicle if you might need the money soon. That’s the sum total of relevant investing advice, and I specifically eschew timing as a consideration.

[2] Speaking of stupid, if you’re involved in finance you know about the kind of technical trading analysis that goes by the name Elliott Wave or myriad other fashionable investment timing silliness.

[3] Specifically I bought shares in the Nasdaq Index on the most severely down day of the massive crash in tech stocks, Friday, April 14 2000. This appeared to me to be the final leg down of tech stocks, which had dropped over 30% in just one month. (check out the graph.) It was a brilliant purchase until a few weeks later when the market went significantly lower, and would fall 70% from its peak in March 2000 to trough in September 2001. I also bought shares in the S&P Index during the 2008 crisis, on October 8 2008 (down 19% on the year) and again October 26, 2008 (down 35% on the year). Again, momentarily brilliant purchases until that falling knife cut even lower all the way through March 2009. The lesson: timing the market is a mug’s game. But, it may be satisfying when understood as a psychological and superstitious trick.

Post read (20506) times.