Japan is a weird financial outlier, and the last month or two has been a reminder of just how especially weird it is.

Stock Market returns

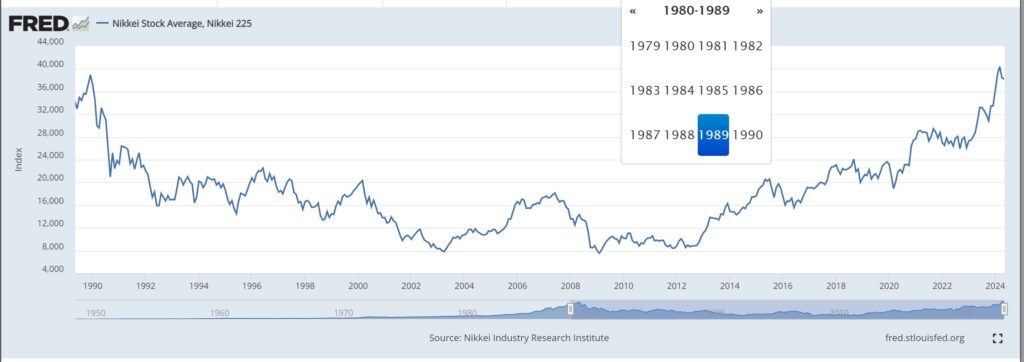

In nominal terms, an investor in the Japanese Nikkei 225 index has needed 35 years to get back to break-even, which finally happened in 2024. That’s a really long time.

December 1989 marked the absolute peak of the Nikkei 225 index, when it traded above the 38,000 level for the month. It took until early 2024 (just this year!) for the Nikkei 225 to return to trade above 38,000 again. During this 35-year round trip, the index averaged in the 15,000 range but also traded below 9,000 in 2002 to 2003, and again below 9,000 between 2008 and 2012.

For comparison purposes, a benchmark US index, the Dow Jones Industrial Average, in December 1989 was around 2,700, compared to its level above 38,000 today. Imagine having a choice to purchase Japanese equities in 1989 versus US equities in 1989, and imagine choosing the wrong one.

One lesson I’ve always taken from the market cycle of the Japanese index is that you do not necessarily want to have all of your stock market exposure in one country, however solid and powerful it looks at the time. If you were a Japanese retiree in 1990 hoping to live off your stock market holdings by investing in your own country’s main index, that would have been a catastrophic choice. And yet, US retirees for the most part have between 80 and 100 percent of their equity holdings in US stocks.

Currency

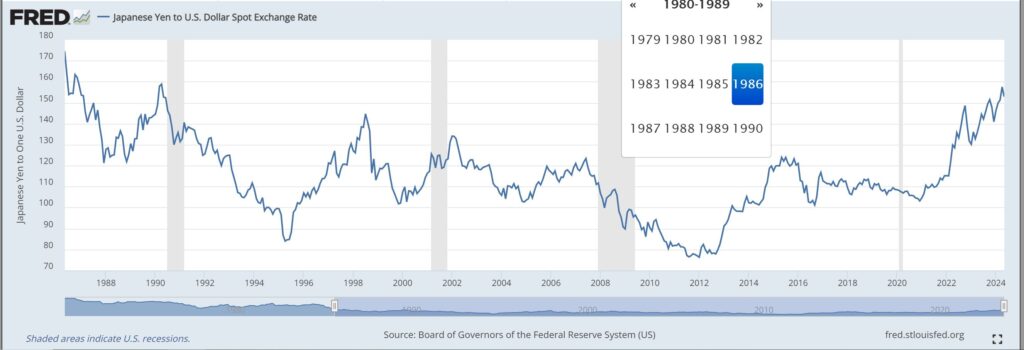

We are also on a roughly 35 year cycle for the Japanese currency, then yen.

On the last day of April 2024, the Japanese yen seemed to flirt with free-fall, weakening dramatically. As of this writing the yen to dollar ratio – hovering around 150 yen to the dollar – is the weakest level that it has been since 1990.

The number of yen needed to buy $1 has only briefly and rarely stayed above 150 – meaning the currency hasn’t ever been consistently this weak – since 1986.

One obvious implication of a weaker yen is that Japanese exports become more attractively priced for foreign consumers. Hondas, Toyotas, Sony products, semiconductors, and everything Japan produces at a world-class level becomes cheaper for us and other non-Japanese buy.

For market-insiders, the dramatic yen/dollar moves take place in a very specific context. One of the biggest and most “classic” hedge fund trades – going on and off for about 30 years now – is to borrow yen at low interest rates and invest the proceeds into higher interest rates available in other countries. As rates went up in the US over the past 1.5 years, this trade has become increasingly tempting. The weakening of the yen in late April is believed to be related in part to this classic trade. And the Bank of Japan is believed to have intervened April 30th to prevent the yen from weakening too much too fast.

Another observation about the simultaneous strengthening of the Japanese real economy and weakening of the yen is the unlinking of currency strength and economic strength. As Americans we have the impression that a strong dollar implies a strong US economy. The Japanese example shows that the correlations and direction of causation can be different.

Inflation

As part of its bid to be the finance-equivalent of bizarro-world, Japan has also been trying to kickstart a little bit of inflation in the economy, for a really long time now. Weird, right? In March the nation’s largest union negotiated a 5.28 percent wage increase, the largest in 30 years, and it was welcomed by government and businesses as a sign of economic strength rather than a dangerous sign, as it would likely have been interpreted in the US.

ESG improvements – Japan-style

ESG has developed a somewhat bad reputation of late in investments, but we would be foolish to ignore the G of ESG – Governance. Japan long suffered from corporate practices which we in the US would consider sub-optimal governance. They allowed the survival of “zombie-banks” long after their 1989 bubble burst. Companies on the Japanese stock market long traded below book value because companies hoarded cash, did not pay dividends, maintained themselves in cozy but inefficient conglomerates, and had few outside independent directors. Japanese banks and insurance companies used to own something like 31 percent of public shares and now own 6 percent. Foreign ownership of shares has climbed from 4 percent to 30 percent. Boards of corporations were considered notoriously insider-focused and insufficiently shareholder-focused. Now in 2024 it is a lot less cozy.

The head of the Nikkei stock exchange in 2023 basically told member companies of undervalued stocks that they had to make plans for becoming more shareholder friendly – such as do share buybacks, pay dividends, and divest non-core businesses. Companies that fail to make governance improvements for the benefit of shareholders now get named and shamed by the head of their main stock exchange. The G in ESG improvement is apparently working in Japan.

Anyway, why should you care, as an American investor, about this 2024 Japanese revitalization, the end of a 35-year cycle?

I can think of a few reasons. First, they are our most powerful ally in Asia, so it’s good they are getting financially and economically stronger.

Second, the extremes of market moves, currency moves, and inflation moves remind us of how little we should take for granted when it comes to the limits of our macroeconomic knowledge. Japan is regularly the bizarro-world outlier that humbles us.

Third, Japan is a cautionary tale about having all of your geographic equity exposure in just one country, just one currency, or just one narrow sector. So, diversify! If you are all in US stocks, maybe you need some other countries in your portfolio?

Maybe including, gulp, Japan?

A version of this post in the San Antonio Express News and Houston Chronicle

Post read (15) times.