The air is just different owning business equity rather than earning a fixed income with a salary. Can you smell it?

The air is just different owning business equity rather than earning a fixed income with a salary. Can you smell it?

I left Goldman in 2004 and have been downwardly mobile, career-wise, ever since.

I’ve also never been happier.

I’ve written before that one of the keys to feeling and being wealthy is do something that you love and that you would do regardless of the compensation.

Now, I can’t prove the following statements, but I believe them to be true:

Working for yourself, in a business you founded, makes it much more likely that you’ll do something you love.

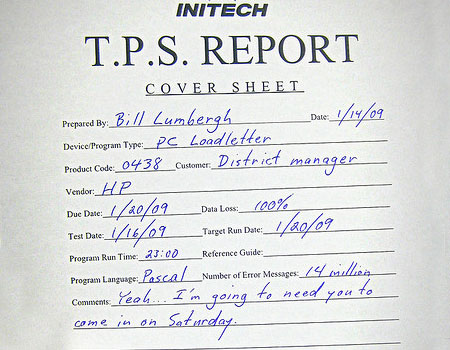

Working for someone else, for a salary, makes it much more likely that you’ll be asked to come in on Saturdays to work on the TPS reports. And, um, Yeeeeahhh, that’d be great.

It’s weird to say this, but it’s true: Doing the TPS reports for your own business doesn’t feel that bad. Even on Saturdays, it’s kinda fun.

Doing the TPS reports on a Saturday for someone else, however, encourages the kind of anomic existentialism that puts you in deep communion with the overwhelming sadness of the universe.

In life, there’s no getting away from the TPS reports on Saturdays, there’s only a choice about how it will feel. One of my main arguments for starting your own business is that it feels different.

And now for some less important, but still relevant, arguments in favor of entrepreneurship.

Taxes

The tax code was written by and for business owners,[1] not by or for salaried employees. So if you’re ever curious why taxes for salaried employees seem unfair, whereas businesses seem to pay less in taxes, that’s why.

Retirement

Did you know you can save about 3 times more per year in tax-advantaged retirement accounts if you’re a business owner than you can as a white-collar employee earning a salary, with a 401K plan? It’s true. But don’t just trust me, look it up on The Google. The Google never lies.

More importantly, many successful business people want to control the timing and conditions of their own retirement, on their own terms.

When you do someone else’s TPS reports, the company gets to ‘retire’ you when they choose. When you do your own, you choose.

Not everyone wants to work forever, but for those people who do, business ownership gives you the control and options.

Please see previous post on Entrepreneurship Part I – The difference between equity and fixed income

And Entrepreneurship Part II – Lessons from finance

Post read (13380) times.

5 Replies to “On Entrepreneurship, Part III – the air, the taxes, the retirement”

If Google never lies then you are the first person to use the term anomic existentialism. Hey, do you suppose there is a philospher in you just waiting to bust out? Also, in my insustry a “TPS” (Test Procedure Report) is called a “PQR” (Procedure Qualification Record) and it reports on the validity of a “WPS” (Welding Procedure Specification).

“Bankers Anonymous: Helping Fight Anomic Existentialism since 2012” – TradeMark Bankers Anonymous, Copyright 2013, All Rights Reserved. All reproduction of this phrase without the express written consent of Bankers Anonymous, Lloyd Blankfein, and Ben Bernanke is strictly prohibited. Unless you send us $1,000 each time. Thank you.

Also, good to know about the TPS, PQR and WPS. If you could come in on Sunday, and get those to my desk right away, that would be great.

I’m a typical “Peter Gibbons” M-F and even a few Saturdays. The simple fact is that our educational system does almost nothing to promote the understanding of equity, whether it’s capital equity, sweat equity, or the equity derived from exposure to risk. In fact, there are incentives built in to the educational system to ensure that there is an ever-increasing supply of wage-labor talent who will never know (or want to know) what goes on a balance sheet. I run an extremely small business in my spare time. I generally find it impossible to have a discussion with a fellow “Peter Gibbons” about matters of business finance. The guy in the next cube over just isn’t capable of having a discussion about internal ROI calculations, cost-basis, or derivatives. That’s really sad to me. So, I come to Bankers-Anonymous to get my fix. Mmmm-kayyy?

Glad to be part of the dialogue!