One thing worse than paying our taxes is the idea that other people avoid paying their fair share of taxes.

One thing worse than paying our taxes is the idea that other people avoid paying their fair share of taxes.

On the subject of tax avoidance by other people, I can think of at least three principal feelings. As the kids say, I feel all the feelings.

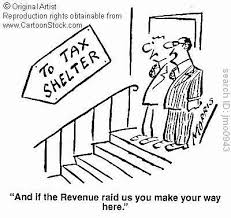

Outright tax fraud

People everywhere on the political spectrum can get angry about outright tax fraud, whether it’s hiding income in offshore accounts to avoid income taxes or shielding inheritances from estate taxes.

A new book by Gabriel Zucman The Hidden Wealth of Nations estimates the size of offshore wealth at $7.6 trillion worldwide, or 8 percent of global wealth. In the US, Zucman estimates $35 billion in lost tax revenue per year due to hidden assets. Meanwhile, governments worldwide lose up to $200 billion in annual revenue from hidden tax havens, with a significant burden of this $200 Billion in fraud falling on developing countries’ governments.

Wealthy folks hold financial assets principally in Switzerland, Luxembourg, and known tax havens such as Cyprus or a myriad of islands in the Caribbean.

One exception to my outrage, I suppose, is petty tax fraud such as when my barista fails to report to the IRS each and every dollar she removes from the tip jar at the end of the day. In that sense the minor scale of her tax fraud diminishes my outrage, as well as the fact that the barista isn’t herself wealthy. Also she supplies my drug of choice. Still, fraud is fraud, and it’s never cool.

Clever tax avoidance

My feelings slide from “outrage” over to the milder “envy” when I read about some billionaires’ strategies to legally avoid taxes, such as the strategies explained recently in the New York Times. In an article titled: “For The Wealthiest, A Private Tax System That Saves Them Billions” the authors describe leading hedge fund founders whose investments in Bermuda-based insurance companies reduce their tax bills.

Their ability to guide tax legislation through Congress and to finance presidential campaigns does stick in my craw quite a bit, and should offend those of us who still hold out hope for our democracy. On the other hand, most of the specific clever tax avoidance that the article describes can be described as the benefits of simply owning a business – albeit in their cases, big ones.

Now, of course, you could decide to hate the fat cat hedge fund guys who simultaneously write the rules on creating income tax loopholes and then nimbly leap through those holes to the tune of billions in annual savings. I think generating that outrage is the main point of the New York Times article, and I don’t blame you too much for feeling that way.

Alternatively, you could decide not to hate the player and just to hate the game. By that I mean, understand that a major part of the ‘scandal’ exposed by the article is simply the trick of turning ordinary (high tax-rate) income into long-term (lower-tax rate) capital gains. The other trick – and this is really simple – is to invest in a business that appreciates tremendously in value over a long period of time but that only gets taxed when you sell it. And then don’t ever sell it. Like, to take an example I recently wrote about, buying a stock and holding it for thirty years, or for forever.

Look, I don’t intimately know all their tax tricks, but hedge funders investing in offshore insurance companies mostly just extend this year’s short-term income (a nearly 40 percent tax rate this year) into long-term capital gains (a 20 percent tax rate, eventually). It’s legal. It’s clever. I’m envious, but I’m not particularly angry.

This is basically how Warren Buffett famously pays a lower tax rate than his secretary. When you read about Buffett or Facebook’s Mark Zuckerberg merely claiming the proverbial $1 per year in salary, you really shouldn’t be impressed with their admirable lack of avarice. Rather, you should note their tax savvy. They make their money through (tax-advantaged) business ownership rather than through (tax-disadvantaged) wages.

It’s an open debate – actually it’s not, but maybe should be? – whether labor ought to be taxed at a higher rate than capital, as it is today. But those are the rules. And remember the Golden Rule you learned in Kindergarten, “He who has the gold, rules.” So save your hate for the player and just hate the game.

Imitation: Own a Business

By the way, if you personally want to start to save money on taxes like a baller, you need to own your own business.

I’m not your accountant, and you really shouldn’t take tax advice from some blogger you found online. But you should set up your own business – like today – if you want to reduce your personal tax bill.

Will you use a cellphone and monthly internet service for your business? What about a computer for record-keeping? Or perhaps a car with your business logo on it? If you are in the 25 percent income tax bracket, and those are legitimate business expenses, all of these will cost you 25 percent less, in after-tax terms.

If the business you own happens to pay you annual profits in dividends, you might enjoy favorable income tax treatment, when compared to taxes on ordinary wages.

If you can control the timing of when you actually get paid by the business you own, you may realize considerable income tax savings through timing your income from one year to the next. If your business makes an expensive investment this year that happens to reduce your annual profit, you may end up paying little to no taxes this year, even as your business grows.

So, my journey from outrage, to envy, to imitation can be summed up as:

Workers of the World, Unite! Start up your business today! You have nothing to lose but your chains (And your top tax rates!)

Unfortunately, as Marx and others discovered with the Communist Revolution, this is easier said then done.

Frankly it’s pretty difficult to find money for starting up your small business.

A version of this post ran in the San Antonio Express News.

Please see related posts:

Startup Finance – All The Terrible Ways

Getting Started – Entrepreneurship

Entrepreneurs: Pack Half the Stuff and Twice the Money

Entrepreneurship Part III – The Air, Taxes, Retirement

Entrepreneurs – Are you a touch funny in the head?

Post read (453) times.

8 Replies to “Tax Avoidance – All The Feelings”

This blog post really struck a nerve with me because it’s exactly how I feel. I think it was Blackrock when it went public the founders, not surprisingly, made 100s of millions of dollars. Not only did they make a sh*t load of money they paid very little tax, a mere 7%. The thing is 7% of billions is still 100s of millions of dollars paid to Uncle Sam! Same with the Walton Family Sam Walton when he first started the business put it in each of his kids names not his. How many people have that kind of foresight!

Garth Turner (www.greaterfool.ca) had a huge influence on my thinking when he said and I quote. “Most people, of course, simply don’t understand how they’re taxed or what to do to minimize the impact. They also don’t realize how the tax system is skewed to ensuring the rich stay that way.”.

Up to that point my focus was on just on trading and investing but the fact I live in Germany but have investments in Canada meant I had to deal with this. So as I began to dig into it I realized that there was a lot more to this than meets the eye. As Garth said, understand the tax system and work to reduce the impact.

In Germany you are taxed as a family. Any money I earn is simply added to my wife’s income and visa versa. if we both make 50 grand it’s as if I made a 100 grand. Our marginal tax rate is 45%. There is also the issue of the healthcare levy (aging population and such) which can really take a bite out of your earnings especially at the lower end. I was looking at a marginal tax rate of over 50%. I also understood that while profits are taxed at 50% losses also reduce your income in the same fashion. With proper planning you can turn a cash flow positive real estate investment into a tax loss.

So while most people moan about the high taxes here I off handily mention that my marginal tax rate is -5%. In other words for every Euro I earn I get 5 cents back from the government. Yes Garth was 100% right the tax code was written by the wealthy for the wealthy!

Sorry about the long comment but I’m really passionate about this.

Rob

Rob, Thanks so much for writing in…that point about the tax code being written by and for the wealthy is such an important point that most people don’t get, and then don’t get to take advantage of.

Maybe you’ve already seen this post I wrote in 2012, but it has another angle on the same theme: http://www.bankers-anonymous.com/blog/adult-conversation-about-income-tax-policy/

Excellent!

BTW Garth is our (canadian) version of Jim Cramer 🙂

Also I didn’t know about Garth Turner but now will check it out…

Here’s a great example of this thinking

We are moving back to Frankfurt next year, plan on kicking out tenant and renovating the place. if we do the renos while the tenant is still there it’s tax deductible, afterwards not!

I agree on the ‘don’t have the player, hate the game’ comments. I’ve often wondered why instead of being envious or jealous or angry at people who are playing the game well, people don’t just try to become just as skillful at playing the game. Instead of being angry someone is wealthy and enjoys privileges of wealth, figure out how you can emulate their behavior and become wealthy, too.

Great post, thank you!

Speaking of that “open debate”… Do you know what the arguments are for labor being taxed at a higher rate than capital gains? Taxing dividends at a lower rate (kinda) makes sense (this is money previously taxes, as corporate earnings) but what about capital gains?

I’ve always assumed labor is taxed higher than capital because of the Golden Rule. Meaning, “He who has the gold, rules.” So capital owners write tax law.

As for an actual strong argument…I guess maybe because it “encourages investment?”

But by that same logic, a tax on wage income should be eliminated/reduced because it “discourages work.”