A version of this post ran in the San Antonio Express News.

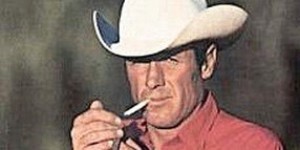

I recently used a reader question about a stock with ticker symbol MO – also known as Altria, and formerly known as cigarette maker Phillip Morris – to talk about investment returns.

I suspect readers of my column on calculating investment returns responded “ok, yes, fine, thanks for the theoretical treatise, but tell me how do I make money?”

Interestingly, MO stock can tell us a thing or two about that question as well. A contrarian like me cannot resist the opportunity to discuss MO in terms of:

- Socially responsible investing vs. sin investing, and

- Investing in innovative companies, and

- A five-year bet, on paper, I’d like to record

On ‘socially responsible’ Investing

I previously wrote about how I do not advocate purchasing ‘socially conscious’ mutual funds.

To summarize those ideas: I don’t like the costs of a typical socially conscious mutual fund; it’s difficult to match up large public companies with one’s specific moral compass; and the returns of such funds may not keep up with the broader market.

In fact, the opposite of ‘socially conscious’ investing – aka ‘sin’ investing – may be a far better idea, at least for making money on your money.

On ‘sin investing’ and efficient markets

When my daughter and I discussed the first stock she should buy with her tooth fairy money, you can be certain that Altria was not on the list of possibilities. (FYI we went with Kellogg, “because Rice Krispies make a lot of noise.”)

While our choice to avoid buying a company like Altria was not market moving,[1] that choice multiplied by many billions of dollars by other similarly-situated investors can leave socially unappealing companies like Altria undervalued. In other words, the fact that cigarette smoking is totally disgusting is the key to Altria’s attractiveness as a stock.

Wall Street Journal columnist Jason Zweig recently highlighted a fund built specifically to take advantage of the aversion many investors feel for stocks in certain industries such as tobacco, alcohol, weapons, and gambling.

The fund – formerly known by the catchy name ‘Vice Fund’ but now going by the more staid ‘USA Mutuals Barrier Fund’ – has had a good record beating a broad market index by nearly 2% per year for the past decade.

I generally do not believe that mutual funds can consistently outperform comparable market benchmarks.

Yet even an ‘efficient markets’ guy like me can imagine that systematic aversion by some investors to some ‘sin industry’ companies creates opportunity for other investors.

By the way, I’m not advocating actually investing in this fund, because the management fees, at 1.46%, run well above what I would consider for my own account or recommend for others. But I think their success may – possibly – highlight an inefficiency in an otherwise extraordinarily efficient market.

Most Successful Company In The World

Finance writer Morgan Housel featured MO stock, Altria, a few weeks ago in a post on the Motley Fool site calling it “the most successful company in the world.”

Before identifying Altria as his featured company, he described the long-run returns of stock ownership:

One dollar invested in this company in 1968 was worth $6,638 yesterday…that’s an annual return of 20.6% per year for nearly half a century…What company is this?

On Innovation and stock investing

And then Housel built the suspense before revealing the company as Altria, tongue firmly in cheek:

…It had to have been revolutionary. It had to have been innovative. It must be in an industry that changed the world – probably the biggest trend of the 20th Century. It must have done something no other company could do.

And then Housel goes on to reveal – in a way that thrills an incorrigible contrarian like myself – that this world-beating stock is in an unattractive industry, one that suffered massive declines and lawsuits over the past 30 years.

Most interestingly to Housel, and to me for that matter, tobacco as an industry barely innovates at all. And that, Housel goes on to say, is another key to its success.

Innovation is super-expensive. Innovation is risky! Innovative companies frequently die. Innovative companies in rapidly evolving industries get beaten by newer upstarts.

By the way, Tesla Motors, to name one public company that I’m reasonably certain will be dead in 5 years, despite its $25B market cap, is an innovative company.

But that doesn’t make it a good stock to own.

Tobacco delivery is not innovative, but rather something far more valuable for a stock: It’s profitable.

A few final thoughts

- I don’t own MO, except probably tucked away as one of a few thousand companies in some broad index fund I own in a retirement account.

- I have absolutely zero opinion on whether one should or should not own MO stock for investment purposes.

- Would a few people mark their calendars for five years on Tesla and let me know how I did with my call? Because I AM SO RIGHT.

[1] My daughter’s stock picking is NOT YET market moving. But look out, Bill Ackman, she’s gunning for you.

Post read (2093) times.

One Reply to “Sin Investing”

I’ve read recently where someone cataloged stocks like MO as ‘defensive stocks’, good stocks to own during a recession or economic downturn. I am of the opinion that if it is good to own during a recession, it must be terrific to own during a boom cycle.

If people smoke to take the edge off during tough times, I’m sure they smoke more to celebrate during good times.

A future column on ‘offensive’ versus ‘defensive’ stocks, perhaps?