The Chapter 313 Monster Revives in Texas

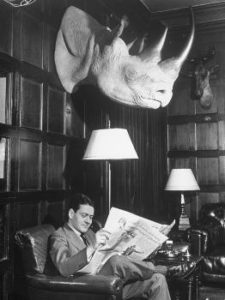

You know how in the final minutes of your favorite horror movie, when our plucky heroes kill the beast with a desperate last ditch effort,

You know how in the final minutes of your favorite horror movie, when our plucky heroes kill the beast with a desperate last ditch effort,

Try to see beyond the Financial Infotainment Industrial Complex to the economic dashboard

An odd part of Build Back Better

Roblox, direct listings, and breaking investment rules in order to teach lessons

Viewing the Biden bills as a YOLO, a series of untried experiments in fiscal policy

I am attempting to model good financial writer behavior by inserting some actual boring tax policy discussion into presidential politics. From what I can glean

I founded Bankers Anonymous because, as a recovering banker, I believe that the gap between the financial world as I know it and the public discourse about finance is more than just a problem for a family trying to balance their checkbook, or politicians trying to score points over next year’s budget – it is a weakness of our civil society. For reals. It’s also really fun for me.

The Financial Rules for New College Graduates: Invest Before Paying Off Debt--And Other Tips Your Professors Didn't Teach You

The Financial Rules for New College Graduates: Invest Before Paying Off Debt--And Other Tips Your Professors Didn't Teach You

We’ll let you know when we have new posts!