One of the odd things about listening to Republican candidates for president is their insistence on describing the ‘weak economy’ or the ‘anemic recovery’ of the Obama Presidency. For which they propose a new approach, naturally.

One of the odd things about listening to Republican candidates for president is their insistence on describing the ‘weak economy’ or the ‘anemic recovery’ of the Obama Presidency. For which they propose a new approach, naturally.

And obviously we understand why they say that. But just to be clear – that’s crazy talk.

“The US Economy,” if such an abstract thing even exists, may be described in short-hand by

- The National Unemployment Rate

- The Inflation Rate

- Gross Domestic Product (GDP) growth

- Asset Prices – Like a broad US stock index (and maybe housing)

There are obviously many other things that impact how people feel about the economy, but on the grand scale of these four economic conditions – GDP, Unemployment, Inflation, and Stocks in 2015 – it doesn’t get any better than right now.

The Unemployment Rate

The Bureau of Labor Statistics reports a 5 percent national (seasonally adjusted) unemployment rate, the lowest since 2008. The unemployment rate has only rarely been this low since about 1971.

Inflation

The past year’s inflation rate (through October 2015) was 0.2%, a ridiculously favorable rate. This is a stunning rebuke of the chicken-little claims about loose monetary policy since 2008, and it partly explains why the Federal Reserve waited so many years – until this week – to begin raising interest rates. No inflation. The last three annual inflation readings this low were 2009, 1955, and 1949. Again, it doesn’t get any better than this.

GDP Growth

The 2.4 percent annual GDP growth in 2014 – a crude measure of our increasing national output and wealth – is a reasonable historical rate. It’s grown faster in the past – an average of 3.22 percent since 1948 – but it sure beats shrinkage, and it’s not anything close to a recession or even particularly ‘anemic.’

Asset Prices

As of this writing the S&P500 Index is within spitting distance (off 3 percent) from its all-time historic highwater mark of 2134, something that could be breached without any warning in a day, or week.

In sum: We are living through the kind of incredible boom-time economic conditions that – as the 1980s hair-metal band Cinderella sang – you “Don’t Know What You Got ‘Till Its Gone.”

When things get worse in the future, we will look back fondly to recognize 2015 as the Goldilocks situation that it was.

So, please guys, stop complaining about “The Weak Economy.”

“The US Economy” – at least in aggregate – is humming along awesomely.

Now, let me clarify: I don’t give President Obama credit for this economic boom. Frankly, no US president deserves much credit or blame for the performance of an economy during his tenure. We can’t stop critics or supporters from assigning credit and blame – that’s just what critics and supporters do – but thinking people (psst, that’s you and me) know better than to believe in it.

A Non-Crazy Position

One sort of reasonable position to take is that there’s no such thing as ‘The US Economy,’ but rather a variety of regionally and demographically-specific financial conditions. Think of South Texas, or rust-best manufacturing, or our inner cities.

“The economy” of South Texas for example is headed for an apocalyptic set of oil-based bankruptcies right now.

The “manufacturing economy” could be described as anemic, and is in a multi-decade secular decline. That will be true until, well, until always, because we pay people more money in this country than they are paid to do the same manufacturing jobs in other countries, which makes us less competitive in manufacturing. Overall that’s a high-class national problem, because it means workers get better pay here than in other places, but it obviously doesn’t feel like a blessing to traditional manufacturing employees.

And then there’s the “inner city economy”: high-school dropouts in our inner cities face inter-generational poverty for which there is no cure in sight. To a 20-24 year-old black man in 2015 – experiencing a 16.7 percent rate of unemployment right now – the difference between a recession and a boom in our overall economy may be hard to see. It likely feels like it’s always a recession in the inner city. The Obama presidency didn’t change that. Johnson’s “War on Poverty” didn’t change that. The economy will be weak in the inner city until college outpaces prison as the most-likely institutional destination for ambitious young black men.

It’s The Inequality, Stupid

One of my pet peeves of Presidential candidate discourse – and Rs and Ds do this in equal measure – is the laser-like focus on ‘middle-class jobs,’ as if everyone is middle class or above in this country. We engage in a weird collective blindness, as if pockets of extraordinary poverty don’t exist.

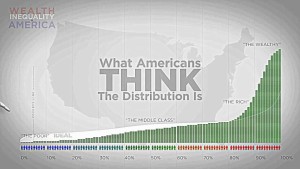

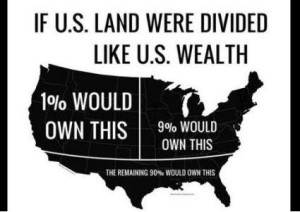

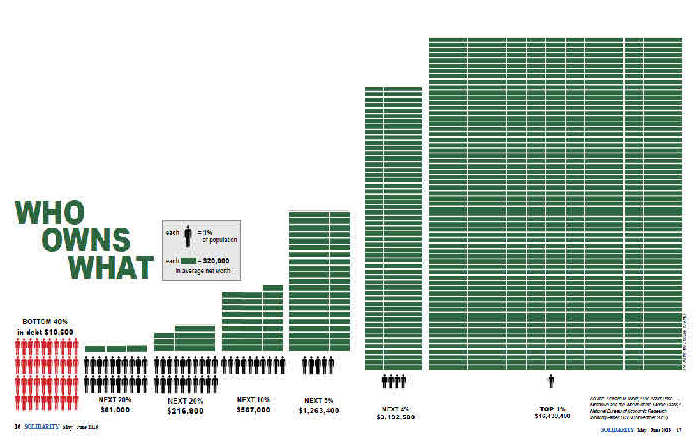

The so-called “Obama recovery” can seem weak to many because a booming economy produces very unequally-distributed benefits.

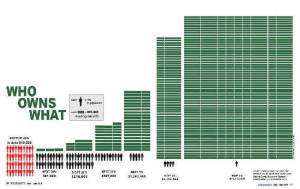

For the 50 percent of American households currently boasting zero to negative net worth, this “awesome economy” means very little.

For the top 10 percent of American households – who control 85 percent of financial assets – there’s nothing ‘anemic’ about the economic recovery of the Obama years.

With stocks up more than 100% since the Great Recession of 2009, in fact, the “awesome economy” of the past 7 years amply rewarded existing owners of wealth. Obviously, the other 90 percent of American households should feel differently. They’ve benefited very little by comparison.

There’s plenty to be upset about during the “Obama recovery.” It’s not at all true – as I think too many candidates for President argue – that the recovery is weak. It’s that the recovery is unequal.

A version of this post ran in the San Antonio Express News.

Post read (272) times.