Note: A version of this post appeared in the San Antonio Express News.

Dear Money: I miss you so, so much.

I recently mailed off – with deep feelings of loss – two of my biggest checks of the year: one for real estate taxes to the county where I live and the other to the IRS for estimated federal income taxes.

After we said our long sorrowful goodbyes at the US Post Office, money and me, I wiped those tears away, threw my shoulders back, and bravely walked back to my car. No looking back. Please, county and federal government, take good care of my money. I raised it with my own two hands, and I dearly loved it.

Don’t worry, though, this is not going to be an anti-tax rant. I’m not a TEA Party member. [1]

On the contrary, over the years I learned to embrace what my accountant taught me: If you think you pay a lot in taxes, try to remember to be happy, because it means you made what to you is a lot of money that year. Or, in the case of real estate taxes, paying a lot means you own valuable real estate.

Seen that way, complaining about paying high taxes is unattractive in the same way that a guy bemoaning the cost of expensive repairs on his Porsche is unattractive. I mean, seriously, don’t be that guy.

The key is fairness

While I believe everyone should pay a fair share of taxes, the key word here is fair.[2]

Since I just coughed up too much money in federal income taxes and local real estate taxes, I’d like to complain now about an unfair aspect of federal income taxes. Later, in an upcoming post, I’ll rant about unfairness in local real estate taxes.

Federal Income Tax unfairness

I started and ran a hedge fund for a short while. (This was years before I landed this lucrative gig writing financial rants online, for free. But anyway.)

The awesome thing about running a hedge fund or private equity fund is just how unfairly advantaged these business structures are, from a federal income tax perspective.

Fund managers earn fees in two ways, a ‘management’ fee and a ‘performance’ fee, sometimes also known as ‘carried interest.’

The more important of these – the ‘carried interest’ or ‘performance’ fee – in most cases gets taxed at a lower rate than other types of income because of the illusion that the performance fee is somehow like ‘long-term capital gains,’ rather than like regular income. It’s not.

But the tax law says it is, so, big tax advantages if you’re a hedge fund manager!

If we were talking about the regular scale of incomes for a blue-collar or white-collar job of people you meet in your ordinary life, the difference in these tax rates might not matter much, something on the order of $500, up to maybe $5,000, tops.

But since we’re talking about hedge fund manager-level earnings – which sometimes hit a billion dollars a year, the difference in the tax code for certain individuals can reach the hundreds of millions of dollars per year level. Which, I don’t know, starts to chafe me in my sensitive areas a bit.

Don’t get me wrong, we can all agree that nobody deserves an unfair tax break more than private equity and hedge fund owners, but at a certain point we begin to wonder about the extent of the unfairness of it all, no?

Please see related posts on taxes:

Shhh…Please don’t talk about my tax loophole

Adult conversation about tax policy

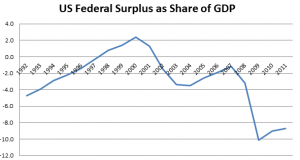

[1] A quick aside to my liberal friends who think the TEA Party is something new. Unhappiness about paying taxes (TEA, as we know, stands for Taxed Enough Already) is as American as Apple Pie, the Star Spangled Banner, and eating greasy food until you nearly burst, on Super Bowl Sunday.

The drunken faux-Indians of the Boston Tea Party Patriots hated paying taxes to the English King. The death-seeking gun-nuts of the Alamo hated paying taxes to Mexico City, and the tyrant Santa Anna. A complete history of the United States could be written using tax-opposition as the prime motive for all major events. I’m not saying TEA party folks aren’t wacky (because many are!) but I am saying at least they have a long list of historical precedents from which to draw political sustenance.

[2] A quick aside on fairness: Fairness, of course, is in the eyes of the beholder.

In my family we retell the story of my super-cute niece, then aged four, who announced one evening: “It would be fair, to me, if I got to take a bubble bath after dinner.” She had learned enough by age four that “being fair” was important to adults, but like many of us, decided to interpret fair according to her own worldview. Since then, I frequently tell my family over dinner that it would be fair, to me, if someone drove out to Dairy Queen and bought me a treat, like, right now. This never works. Anyway, fairness. It’s important in the tax code.

[3] In the tax world, there are always exceptions to everything so I am simplifying greatly and using these hedging words like ‘usually’ and ‘sometimes’ and ‘often.’

Post read (1120) times.