I’ve already talked about the link between work and wealth but what about the ties between death and wealth?

A buddy in New York used to tell me that the right way to manage your money is to have just enough to cover your bills until the day you die, and then bounce the check to the funeral home. He was kidding, I think. That poor funeral director! But there’s real wisdom in his joke.

One Definition of Wealthy

One of my ways of defining ‘being wealthy’ is similar to my buddy’s joke. I think we should measure whether we have enough money to cover our lifestyle costs up until the day we die. If you can, then you’re wealthy.

In my definition, taken to the extreme, we can see how we are all ‘wealthy’ at least a few minutes before we die, since we no longer need to spend money to maintain our lifestyle. “I’ll never have to work for the rest of my life!” the dying person could think, and that is true. So, you’re wealthy!

Less absurdly, if you knew you had just a year to live, and no particular concern for your heirs, would you have enough saved to cover your lifestyle costs? If you own your own time, to spend exactly as you like – again, I think that makes you wealthy, by one sort of definition.

(Note that my definition of wealthy never considers heirs, because in my experience children really don’t deserve the money.)

Ideally, of course, we arrive at that level of ‘wealthy’ before the moment of death or a year of terminal illness. We get there, ideally, with many more years of our lifestyle costs covered. This is generally the goal of most of us as we approach retirement – that we can own our own time without having to work to earn more money.

A fewer number of fortunates manage to acquire enough, quickly enough, to allow them to maintain their lifestyle even after retiring at a young enough age. This conforms more to our typical societal view of a ‘wealthy’ person, who can choose to quit working relatively early.

Where’s the luxury?

In my idiosyncratic definition of ‘being wealthy,’ you may have noticed that there’s not a single Maybach mentioned. I’m not considering dinner with my girl on a G5 as an “update.” There’s no drinking Mai Tais, sitting courtside, Knicks and Nets giving me high fives.

In fact, since covering my costs until death is the goal, all of those expensive luxuries put my chance of being wealthy at risk. Realistically, if I buy a second home, then I need to make or have that much more money to cover my costs. When I upgrade my car, I’ve got to either have that in the bank or take on higher monthly debt costs. That may mean I have to work harder, or longer, just to cover my lifestyle costs.

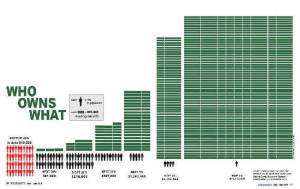

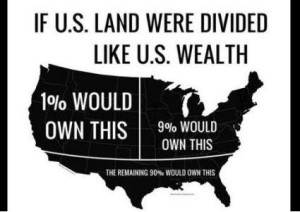

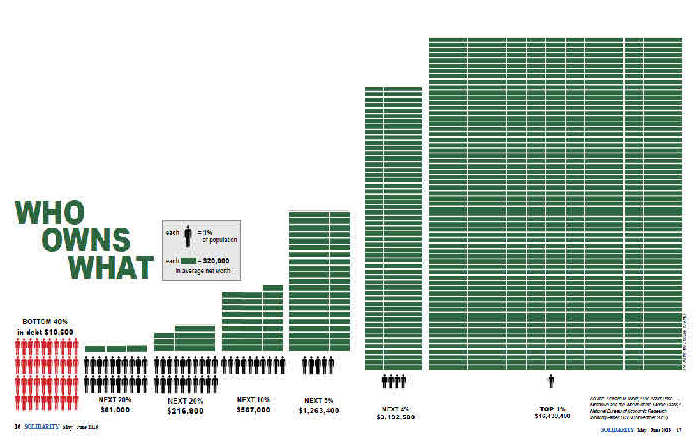

So ironically, all the ‘stuff’ that helps make me look wealthy in reality raises the difficulty of actually being wealthy. You may in fact be ‘wealthier’ than a person making five times what you make, or boasting ten times your bank account. If that other person still needs to work nights and weekends to pay for the trip to Bhutan and the four-car garage – and you don’t – then who’s wealthy now?

Did the chorus for “Luckenbach Texas” by Waylon Jennings just pop into your head as you read this paragraph?

Being Mortal

I’ve been thinking about death after recently finishing Atul Gawande’s Being Mortal. which I highly recommend, by the way.

Gawande’s lesson – that “more” is not necessarily “better” when it comes to medical interventions at the end of life – has its analog in lifestyle costs and my definition of being wealthy. If we have enough, and we have control over how we spend our precious time until death, then we’re better off than the more costly way of living.

Death and Meaning

In a deeper sense, of course, meditating on death may be the key to feeling content with one’s level of material possessions. Being in the presence of a sick or dying person can point us closer to the relative importance of time, possessions, money, experiences, feelings of contentment, and relationships.

Considering our mortality, how much would I pay to experience the sunset at low tide with my daughters? While we still enjoy good health and pain-free bodies, a quiet dinner with my wife has immeasurable value. Could a king’s ransom buy this if we’d lost it? In these fleeting moments of insight, I feel extraordinarily wealthy.

A version of this ran in the San Antonio Express News

Please see related posts:

Post read (189) times.